2024 was a good year

2024 was a good year for retirement but 2025 looks more uncertain

It is customary at this time of year to look back over the previous year and to make predictions about next year. However, anybody who says they can forecast the future is being untruthful, so I am not forecasting, just making some educated guesses.

2024 was a good year for those approaching or enjoying retirement. The stock market, as measured by the FTSE 100, was up 10% and annuity rates were up by a very small margin.

Annuities remain at post credit crunch high

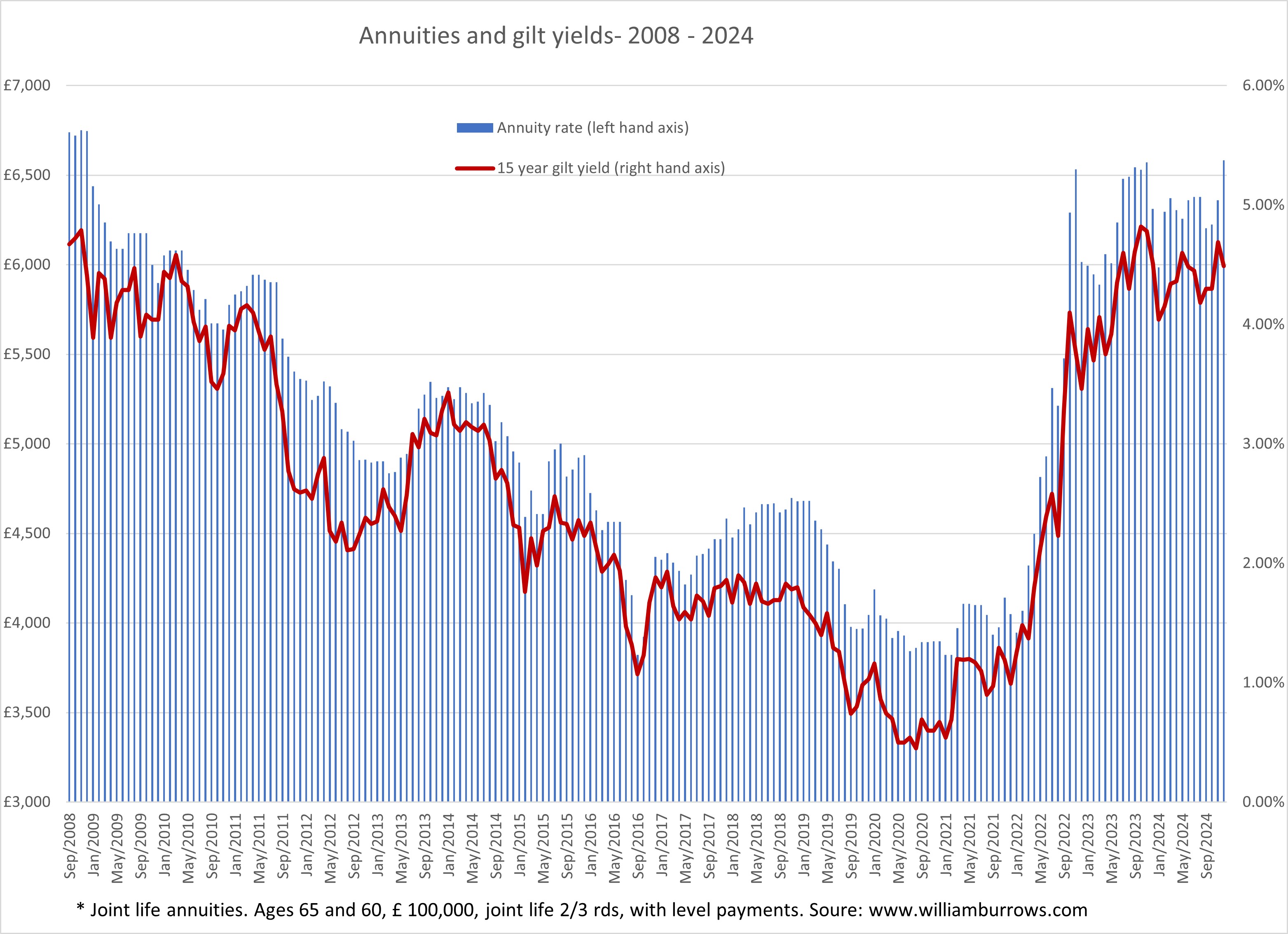

As the chart below shows, annuities plummeted to their lowest levels in living memory in 2020 before leaping up to pre credit crunch levels with a helping hand from Liz Truss’ infamous mini budget in September 2022.

The disastrous mini budget cannot take all the credit for the rise in annuity rates because the main reason why annuity rates started to rise in 2022 was the return of inflation on the back of Russia’s illegal invasion of Ukraine.

As readers will know, annuity rates are priced in relation to the yields from fixed interest investments such as long dated gilts.

Source: www.annuityproject.co.uk, December 2024

Back in 2008 (before the credit crunch) the benchmark annuity was paying about £6,750 per annum gross for a £100,000 annuity. By 2020, this had fallen to below £4,000 per annum, a 40% drop but then rates bounced back and currently the benchmark annuity is paying about £6,200 p.a.

The spike in annuity rates, or as some would say, a return to something like normal yields and interest rates, has resulted in annuities being brought in from the cold and the market has heated up with insurance companies reporting a substantial rise in annuity sales.

The question now is, ‘if annuity rates have peaked how far will they fall next year’?

2024 – annuities were stable

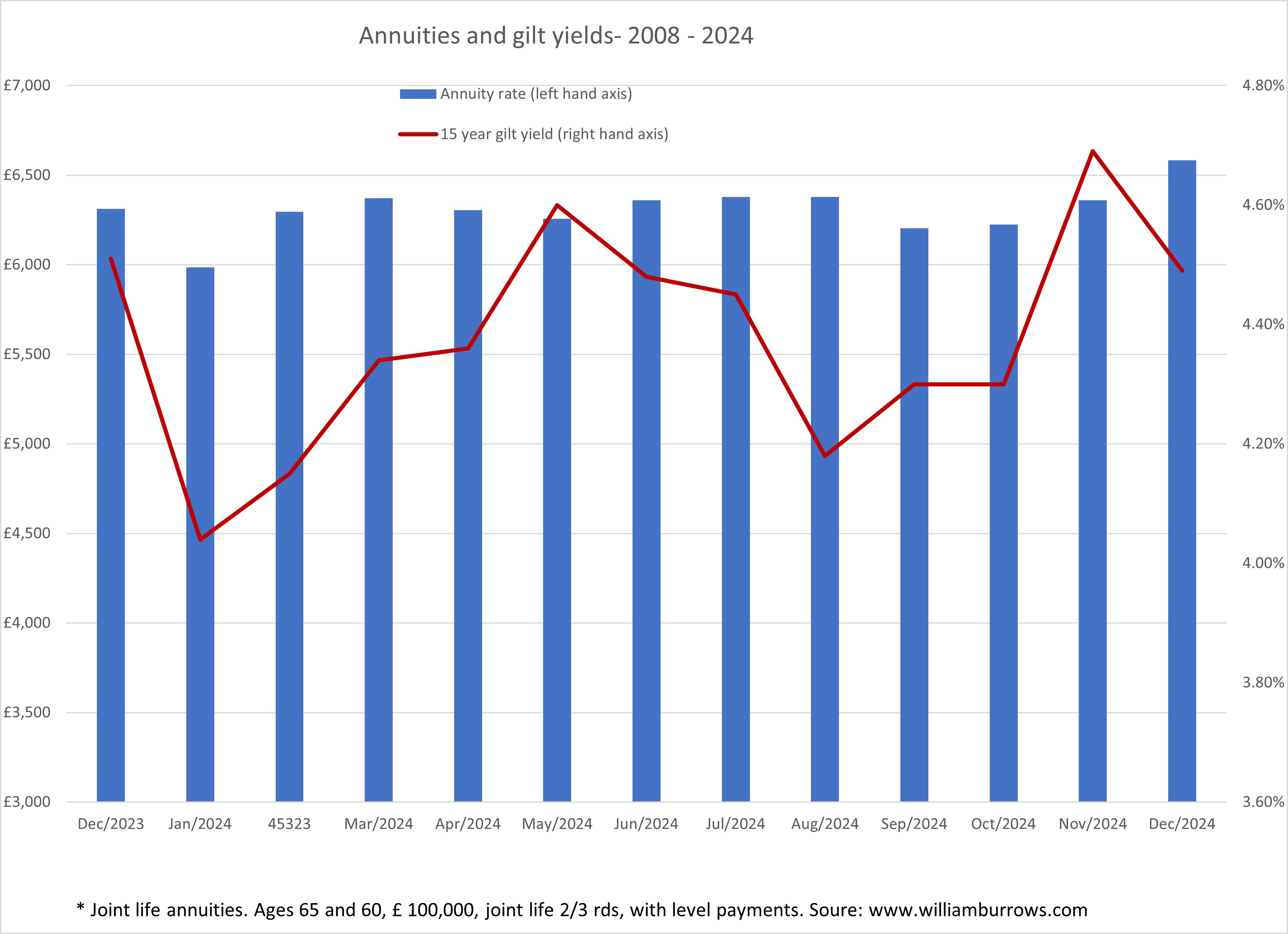

The chart below shows annuity rates and yields for 2024 and clearly shows that annuity rates were relatively stable during the year as yields moved up and down between a narrow band between 4 and 4.6% and yields ended the year at about the level they were 12 months ago, despite the two small cuts in the bank rate.

Source: www.annuityproject.co.uk, December 2024

But if annuity rates hardly moved, the same cannot be said for pension funds which enjoyed a good year, and the FTSE was up by about 10%.

This means that many people will have seen the amount of annuity income they could get increase because they will have had a bigger pension pot with which to purchase an annuity. Obviously, the increase in value of pension funds depends on where they are invested and those invested in lifestyle funds or even annuity protection funds will have had modest returns.

The point is that the amount of annuity income is a product of both the size of the pension fund and the annuity rate. This is something to bear in mind for 2025, but more on this later.

What is in store for 2025?

IHT on unused pension pots

People with substantial pension and other financial assets will need to consider the impact of the new rules which will bring unused pension pots into the IHT calculations on death.

At present, on death, any unused pension pots can be inherited by beneficiaries outside of IHT calculations. From April 2027 this will change, and most pensions and pension benefits will fall into IHT calculations on death. However, unused pension pots can be inherited by a spouse or civil partner without IHT.

The new rules will particularly affect those who were planning to use their pension pots as a way of leaving money to their children or other beneficiaries in a tax-efficient way. There are various ways in which the potential IHT liability can be reduced, and I will be writing about this as soon as the new rules become clearer.

However, many commentators are already saying that is likely that more people will take taxable income from their pension pots in order to reduce future IHT bills. I make the simple point that if income is to be taken from pension pots, especially at older ages, there will be a strong case to consider annuities as well as pension drawdown.

Outlook for annuities

The fate of annuity rates rests with bond yields and these in return will be influenced by a number of factors, the most important of which will probably be the outlook for inflation.

It is tempting to predict that the Bank of England will probably cut the bank rate by another 50 basis points (i.e. from 4.75% to 4.25%) during 2025 and this will result in annuity rates falling by about the same amount. Although this is probably the most likely outlook things could turn out differently.

My best guess is that annuity rates will remain relatively stable albeit falling by a small margin as the year progress if bond yields fall, but annuities should still remain good value for money.

Equity markets

The same may not be true for equity markets but it is unlikely they will be stable. One scenario is that with Trump in the White House the US stock market may rocket. The other scenario is that if the US imposes tariffs, global equities will be volatile. It is too early to predict the outcome so investors should make sure they have well diversified portfolios.

Annuities – still hard to beat

Many people see annuities as an inflexible option which is less attractive than pension drawdown, but the reality is different. With the underlying rate of return about 4.5% (current gilt on 15-year gilts), annuities are a hard to beat compared to taking the same income from drawdown. In order for drawdown to pay a sustainable income similar to the income from an annuity, the pension pot must growth by more 4.5% after charges and an allowance to compensate for mortality drag.

This may not seem difficult but older investors should consider taking less investment risk and if global financial markets go through a volatile period, returns in excess of 5% may not be easily achievable without taking undue risk.

In such a scenario, the peace of mind and security of an annuity may be preferable to a roller coaster ride on the stock market.

This brings me back to my earlier point about annuity income being a product of both the size of the pension fund and the annuity rate.

One eye on annuities, the other on stock market

If you want to maximise retirement income in 2025 it will be necessary to have one eye on the stock market and another on annuity rates. With relatively high annuity rates, but the prospects of falling rates later in the year, and with concerns about the outlook for global financial markets, there will be a strong case for derisking all or part of pension income by arranging annuities in order to benefit from the peace of mind and security that annuities provide.

How strong this case is will depend on individual circumstances and objectives and this means that the case for taking specialist financial advice is stronger than ever.

Help and advice

William Burrows will be pleased to answer your questions

About the author

William Burrows

William has been involved with retirement options for nearly 30 years, advising clients on all aspects of annuities and retirement income options.

He is a regulated adviser with Eadon & Co He has have many years of practical experience in advising clients about all aspects of pension options at retirement and he is passionate about helping people make the right decisions about their pensions and retirement income.

William also publishes guides including the popular ‘You and Your Pension Pot’ and ‘The Retirement Journey’.

He is frequently quoted in the national press and appears on radio, podcasts and videos and writes extensively on retirement income matters.