Best time for annuities

Now is the best time to arrange an annuity since the 2008 credit crunch.

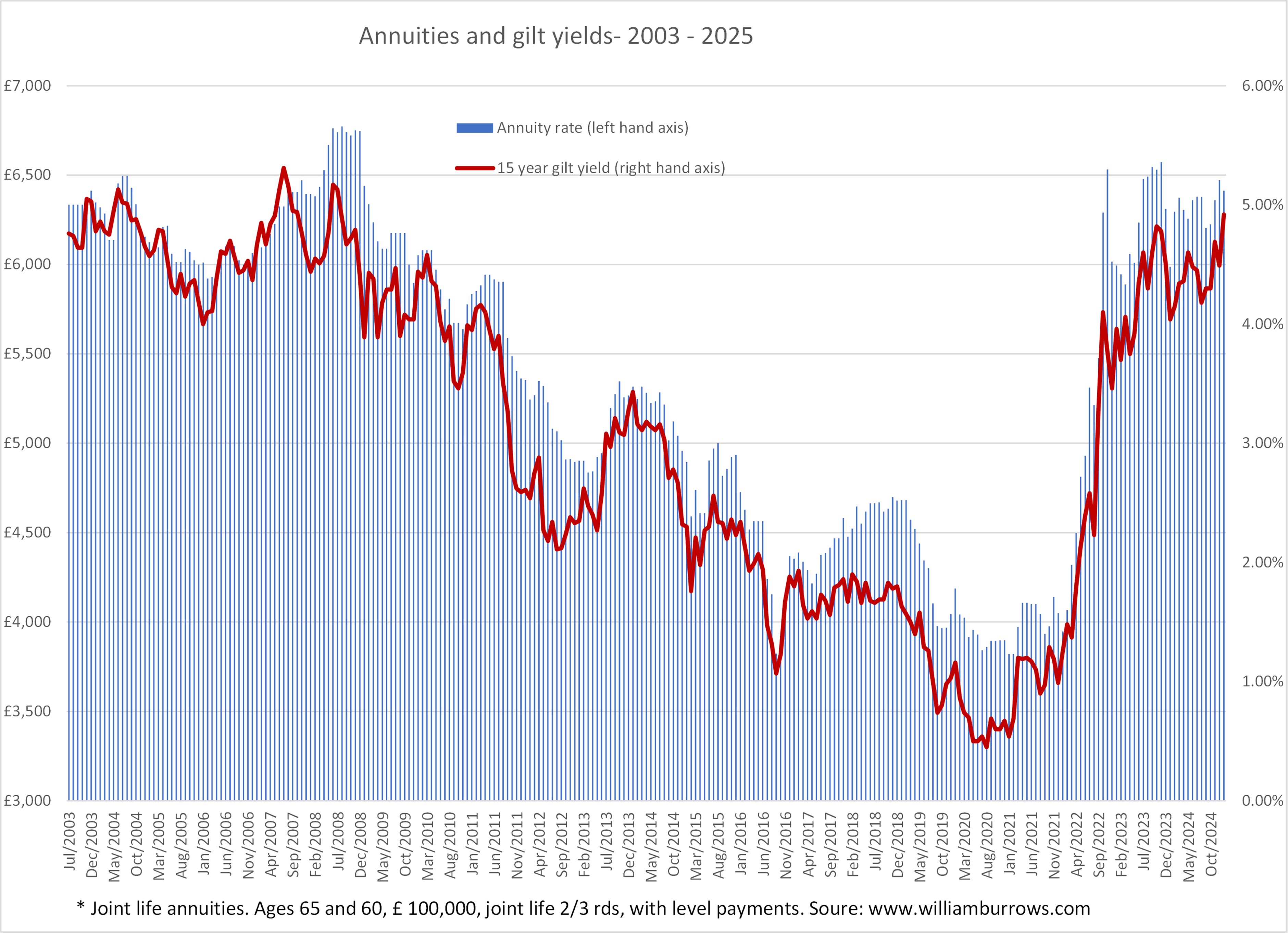

Rising bond yields has resulted in higher annuity rates. Last January, the yield on 15-year gilts was 4.2% and today they are 5.18%. The benchmark annuity (joint life, 2/3rds with level payments for ages 65 and 60) was just below £6,000 p.a. a year ago and today it is up to £6,487. This is an increase of nearly £500 p.a. which is about 8%.

As a rule of thumb, for every 100-basis point increase in yields we can expect annuity rates to increase by about 10%, so the recent increase is close to this.

Those considering purchasing annuities will be asking how much higher can rates go? The fate of annuities is in the hands of bond markets but if we are at the top of the recent gilt yield bubble rates will also be at their peak for the time being.

Annuity and gilt yields are now at levels to not seen since before the credit crunch in 2008 and annuity rates are rising in the back of higher long-term yields.

There are two primary factors that influence annuity pricing: life expectancy and the underlying interest rate.

There is nothing advisers can do about life expectancy assumptions other than declare all of their client’s lifestyle (e.g. smoking) and health details but they can time annuity purchases when rates are high.

The underlying interest rate on which annuities are priced is determined from the return on assets that annuity company invest the money they get from annuity purchases. These investments include gilts, corporate bonds and other fixed interest investments.

After the credit crunch the Bank of England started the policy of quantitative easing. This involved buying bonds to push up their prices and bringing down long-term interest rates. Consequently, and as a result of Brexit, yields fell to an all-time low of about 0.5% in 2020.

Before the credit crunch in 2008, the 15-year gilt yield was over 5.3% and the benchmark annuity was paying £6,750 for every £100,000 invested. By 2020 the same annuity had fallen to about £3,800 and now this annuity is paying £6,500 which means that annuity rates are 70% higher than the 2020 low.

What does this mean for people at retirement age with personal or company money purchase pensions?

An annuity can be viewed in two ways. A policy that pays a guaranteed income and ensures you don’t outlive your income. It can also be viewed as investment with a guaranteed return.

The outlook for 2025 is very uncertain and now be a good time to lock into the high annuity rates.

Those wanting to maximise their lifetime income will find that at these levels’ annuities are a hard act to beat when compared to the alternatives such as pension drawdown.

Those looking to de-risk their pension drawdown portfolios should consider locking into the current 5% underlying returns. A 5% investment return guaranteed for life, or a fixed term with no risk may look attractive in the current climate.

Annuities may have an undeserved bad reputation, but they are still the only policy that pays a high level of guaranteed for income for life with peace of mind and security.

Postscript

Today, 23rd January, the 15 year gilt yield has fallen to around 4.91 so as I expected, the recent spike was a temporary thing.

There is a time lag between changes in yields and changes to annuities. Annuity providers are reporting changes to annuity pricing but I suspect the peak in yields has passed for the time being.

Help and advice

William Burrows will be pleased to answer your questions

About the author

William Burrows

William has been involved with retirement options for nearly 30 years, advising clients on all aspects of annuities and retirement income options.

He is a regulated adviser with Eadon & Co He has have many years of practical experience in advising clients about all aspects of pension options at retirement and he is passionate about helping people make the right decisions about their pensions and retirement income.

William also publishes guides including the popular ‘You and Your Pension Pot’ and ‘The Retirement Journey’.

He is frequently quoted in the national press and appears on radio, podcasts and videos and writes extensively on retirement income matters.