IHT and unused pensions

From 2027, after your death your remaining pension pots may be subject to Inheritance Tax (IHT) but until 2017, you can leave your personal pension pots to your family (or other beneficiaries) free of IHT.

This means, many more people will be drawn into IHT trap and those who may be affected will need to start planning now if they want to mitigate the effects as the new IFT rules will transform the way people will think about their pensions and retirement planning.

It is still early days but many people, especially those close to and above age 75, will be reviewing what to do with their pension pots and one of the things most experts agree on is that it will probably make sense to take more money (income) out of your pension pot and if sensible, gift money to beneficiaries.

The idea is to reduce the value of your pension pot to avoid or reduce IHT on your pension. This is especially relevant for those with large funds.

Planning your retirement and estate planning involves a balancing act between having enough income and capital to fund your retirement and transferring assets to your family before you die to reduce your IHT bill.

Since pension freedoms in 2015 it has been tempting and quite sensible for some people to invest money into their pension as a tax-efficient way to leave money to the next generation. But the new rules on unused pensions and IHT changes this.

How much is inheritance tax and who pays?

Inheritance tax is levied at 40 per cent on estates above a certain amount - don’t forget that there is no IHT on money left to a spouse or civil partner so for married couples, IHT only becomes an issue on 2nd death.

You need to have £325,000 of assets if you are single, or £650,000 jointly if you are married or in a civil partnership, before your estate is subject to IHT.

If you own your home and intend to leave it to your direct descendants you can benefit from the ‘residence nil rate band’. This increases the IHT threshold by £175,000 for each person so it is £350,000 for a married couple, therefore increasing the potential maximum joint inheritance tax-free total of £1million for a couple.

But beware; the residence nil rate band starts being removed once an estate reaches £2million, at a rate of £1 for every £2 above the threshold. It vanishes completely by £2.3million.

There are several ways to avoid or mitigate IHT on pensions, but great care must be taken to make sure you don’t fall foul of the sometimes complex rules and you should always get expert advice from advisers like us.

1. Increase your spending and gifting

There is an old joke about retirement ‘enjoy your retirement and spend most of your money before your die making sure there is just enough to pay for a round of drinks after your funeral’.

The problem with this is we don’t know how long we will live and these leaves us with the problem of avoiding spending too much and running out of money or not spending enough and therefore not enjoying the benefits of your retirement income. (Annuities solve this problem but that is an argument for another article!)

If you think it is likely that you will die leaving money in your pension that will fall into IHT you can consider spending more (watch out for income tax) or gifting money to beneficiaries.

There are some tax-efficient ways to gift from pension funds:

- Take the 25% tax-free cash and gift it away

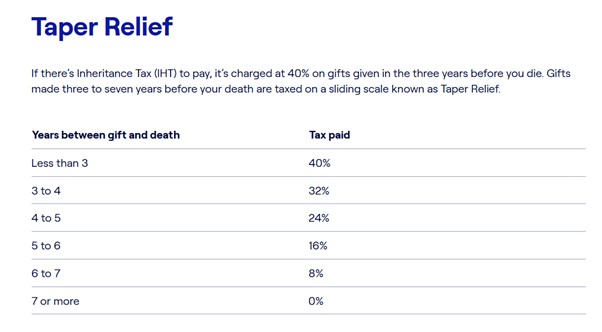

All lump sums (unless they qualify for an exemption) will be subject to the seven-year rule before being fully free of IFT. If the donor dies during the first 7 years of the gift IHT might be payable at a lower rate of IHT because of taper relief.

The so-called 7-year rule is properly known as a ‘Potentially Exempt Transfer’ (PET) with Taper Relief. If the donor dies less than 3 years after gifting money (PET) IHT is charged at 40%. Thereafter IHT is tapered. See table below.

In my experience, most people either have a need for the tax-free cash or are emotionally attached to it so I don’t think many people will gift this cash unless there is a strong need e.g. deposit for a house.

- Make regular withdrawals and gift the income

If the income can be classified as 'normal expenditure from income' these regular gifts could be free of inheritance tax (if they meet the rules). See below for the rules.

Income can be taken from a pension pot either by way of drawdown or annuity purchase. If an annuity is purchased and the income gifted it should be easier to satisfy the normal expenditure from income rules and it will be easier to document.

If the income does not meet the normal expenditure rules, each payment will be a PET (see above).

- Take taxable income and invest it in a pension plan for your children or grandchildren

A tax-efficient way of using surplus pension income is to make contributions into a personal pension for family members and this could include a spouse/ partner, children or even grandchildren.

If the person does not have an income, you can pay up to £2,880 into their pension in each tax year, topped up to £3,600 by basic rate tax relief. Think of this as a bonus from the Government.

The person receiving the pension contribution does not have to have their own income to benefit from the tax relief bonus. The resulting pension pot may end up being more beneficial than the proceeds of an unused pension pot which might end up being taxed twice. IHT first, and then income tax on any money taken out (if the donor dies after age 75).

2. Consider purchasing an annuity

Annuities are my special subject and I make a simple but important point. If other experts are saying it might make sense to take more income from a pension pot then annuities should be considered as they are a good way to convert a pension pot into income for life.

When it comes to taking income, annuities can be a hard act to beat as they maximise lifetime income and there is no risk because the income is guaranteed.

One of the reasons why annuities are not popular is the perception that they are poor value and the money is lost on death.

Annuities are good value, especially at present (February 2025) as the underlying interest rate is high. Where else can you get an effective rate of return of about 5% for the rest of your life with zero investment risk.

Also, for most people, they are more likely to live longer than they expect rather dying sooner. In any case, annuities can have various death benefits e.g. continued income to spouse/partner (joint life) or income and capital guarantees.

As I have already mentioned, it is early days in respect to IHT planning for pensions, but I think it likely that gifting linked to annuity income will become a popular and safe way of transferring money to the next generation.

If you are interested in annuities, we can quotations without charge or obligation

.

3. Convert your pension into tax-free cash and income before age 75

Under current rules, If you die after the age of 75, anyone who inherits your pension will pay income tax at their marginal rate on any money taken out of the inherited pension pot. This raises the prospect of a double taxation if the pot has already been subject to inheritance tax at 40 per cent.

If the beneficiary is an additional rate 45 per cent taxpayer they will end up paying an effective tax rate of 67%.

If the addition of the inherited pension pots takes the value of an estate past the £2million mark the residential nil rate band will start to reduce and the potential tax hit is even greater.

If this is still the case in 2027, it may make sense at the age of 75 to start or accelerate the amount of income taken from the pension pot to reduce the value of the pot and therefore reduce the potential for IHT.

As already mentioned, it might make sense to arrange annuity around age 75.

Even if IHT is not an issue, it normally makes sense to take all your tax-free cash before age 75. If you die after age 75 and have unused tax-free cash it will lose the tax-free status.

4. Take out life insurance to pay and IHT payable by your estate

One of the accepted ways of dealing with the possibility of having to pay IHT is take out an insurance policy.

Taking out a whole of life insurance policy can be a good way of providing money to pay and future IHT liability, so beneficiaries do not have to pay the tax themselves.

You can take out a life insurance policy for all or part of the estimated inheritance tax bill. It should be written in trust so the eventual payout does not form part of your estate for tax purposes and the money will be quickly available.

If you are married or in a civil partnership, normally a 'joint life, second death' policy is best. This means the policy will only pay out to your beneficiaries on the second death. The first death does not need to be insured as the surviving spouse inherits assets free of IHT.

Insurance policies have the added benefit of saving executors time and stress as funds will be available to settle IHT with HMRC, which must be done before probate is granted.

There is no reason why additional taxable income cannot be taken form the pension pot to pay the insurance premiums.

The premiums for whole life assurance will probably be higher than you think, especially for older people and those in poor health. Insurance companies calculate the probability of death and therefore the date of paying out and so the rates will err on the side of caution.

If you are interested in this option we can obtain life assurance quotes without charge or obligation.

5. Save and invest outside your pension

If you have accumulated more than enough money in your pension pot to secure your retirement income, it might make sense to consider other ways of saving or investing your money. If one of the reasons for investing in a pension plan was for intergenerational estate planning then you might need to think again because of the new IHT rules.

Don’t forget that currently tax-free cash from a pensions pot at is capped at £268,275. This is 25% of the old lifetime allowance of £1,073,100. This may reduce the incentive to fund £1m plus pension pots because they will be no extra tax-free cash and the risk of paying IHT on death.

A good retirement adviser will help you explore alternative ways of investing or arranging your finances and this could include, paying down their mortgage, investing in more inheritance tax-efficient assets, or gifting, including to charities.

6. Consider marrying your partner

As already mentioned, a spouse or civil partner is exempt from inheritance tax and that will apply to pension pots too. This means that for many people the inheritance tax 'problem' only arises on the second death.

But those who are in a relationship but unmarried there is no partner exemption so the IHT issue is more pressing.

Some commentators are suggesting that older couples in long-term unmarried relationships may consider getting married to benefit from the IHT exemptions.

However, marriage is an important commitment and love and commitment rather than money issues are more important.

Anyone who is married should check their pension death benefit nomination. After April 2027, for inheritance tax purposes, it might be best for most couples to stipulate that the pension is paid in total to their spouse when they die, rather than express a wish that the pension pot is left to their children or other family members.

Help and advice

William Burrows will be pleased to answer your questions