Pensions & DD

Pension drawdown

A drawdown plan lets you have the normal 25% tax free cash sum and then you can take regular or ad hoc income payments directly from your pension pot.

In many ways, this is similar to taking an income direct from your bank or savings account except your money stays inside a pension plan and you pay tax on any income paid out.

If your pension fund increases in value after taking income drawdown payments you can increase your payments in the future but if your fund decreases in value after taking income drawdown payments you may have to reduce your income payments and at the extreme you could run the pot dry.

The advantages of drawdown include:

- Income flexibility – you can take as much or little income as you need

- Control of investments – you can decide where your pension is invested

- Choice of death benefits – you can decide what happens to your pension pot after your death.

Income flexibility

With pension drawdown you can take regular or ad hoc income payments directly from your pension pot. This means you keep control over your pension pot and have the flexibility to spend and invest your pension pot as you want.

It is important to remember, unlike an annuity, your income is not normally guaranteed and if you take too much income in the early years or if the fund does not increase in value as planned, you could end up with a lower income or even run out of money entirely.

Investment control - Your pension pot can be invested in a number of ways ranging from cash, bonds, equities and even property (you cannot invest directly in residential property).

Investment choice

A drawdown pension plan can be invested in a wide range of things including:

- Cash accounts with banks and building societies

- Pension funds from insurance companies

- Unit trusts and onshore and offshore open ended investment companies (OEICs)

- Investment trusts

- Individual stocks and shares quoted on a recognised UK or overseas stock exchange Commercial property

Typically, a drawdown plan will be invested in some of the above investments in one of following ways:

- Through an insurance or investment company

- On a platform arranged through an adviser

- Self-select (no-advice)

- Self-invested personal pension (SIPP) through an adviser

Investing in drawdown is very different from investing before retirement and therefore it is advisable to take professional advice, not only on the initial investment strategy but in order to have regular financial reviews to make sure the plan is on target.

Death benefits

Most drawdown plans offer three options following the death of the plan holder:

- Pay the balance of the drawdown pot as a cash lump sum

- Arrange flexi-access drawdown for beneficiaries (no income needs to be taken)

- Purchase an annuity for selected beneficiaries, normally a spouse / partner

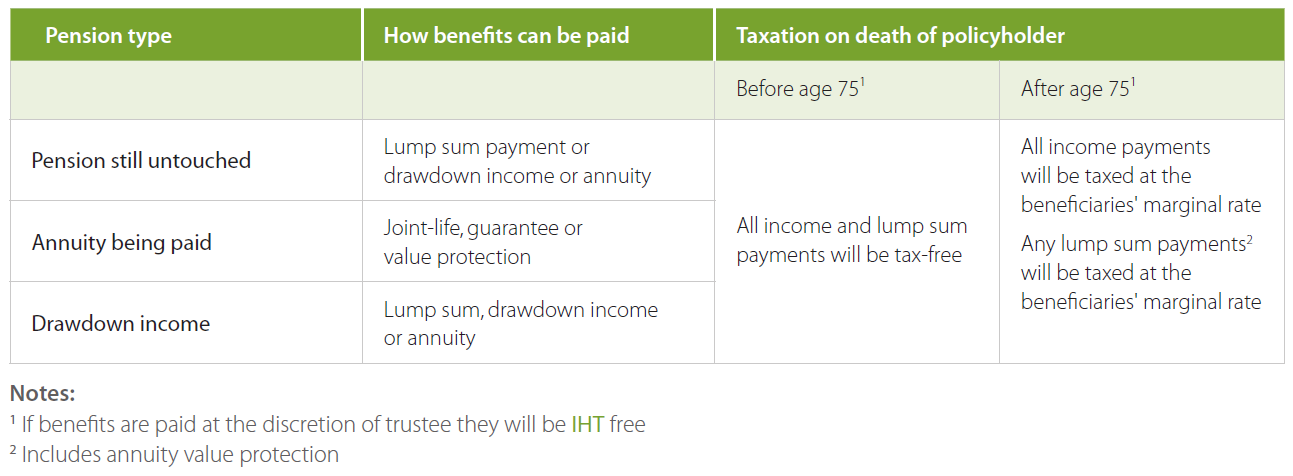

If the plan holder dies before age 75, all payments (cash or income) will be tax free, but if death occurs after age 75, any cash or income will be taxed at the marginal rate of tax payable by the beneficiary.

There are three types of beneficiary; a dependant, a nominee and a successor. A dependant is a spouse, civil partner, child under the age of 23 or someone who was financially dependent on the plan holder. A nominee is anyone nominated by the member and a successor is anyone nominated by one of the beneficiaries. In short, almost anybody can be nominated to be a beneficiary of a pension pot.

Although many people may choose to nominate their spouse or partner as a beneficiary, it is possible to nominate children or other family members or friends as beneficiaries and so the pension fund can be handed from one generation to another.

You can leave money to your family - After your death, any money remaining in your pension pot can be left to your beneficiaries. See the next section for more information.

You can name anybody as a beneficiary. In most cases you will probably choose your spouse or partner as the beneficiary, but you can nominate your children, grandchildren, family friend or even a charity. Technically the final choice of beneficiary is at the discretion of the trustees responsible for overseeing the pension plan but in most cases, they follow your wishes. This means that any transfers or cash payments are normally free of Inheritance Tax.

On death of the beneficiary any remaining drawdown funds may be passed on to their beneficiaries which means that pensions can be passed from generation to generation.

Watch out for

There is a lot to watch out for but by far the two most important things to keep an eagle eye on are the amount of income you take out and where your drawdown is invested.

These two things are intricately linked because of the sequence of return risks. Investing when you are taking income withdrawals is different to investing without taking income and this is because if the returns are low or negative in the early years you will erode your capital fast and it will be hard to recover from early losses.

When you take income from a flexi-access drawdown it will be a trigger event for the Money Purchase Annual Allowance (MPAA).

Although drawdown may seem easy to understand the risks are much harder to understand, especially if compared to the guaranteed income from an annuity.

Help and advice

William Burrows will be pleased to answer your questions